Credit Sense

Your credit score affects so many aspects of your life. We equip you to maximize your borrowing power with a free credit report and updated credit scores, as well as tips to improve and maintain your score and customized loan offers to save you money!

tips to improve and maintain your score and customized loan offers to save you money!

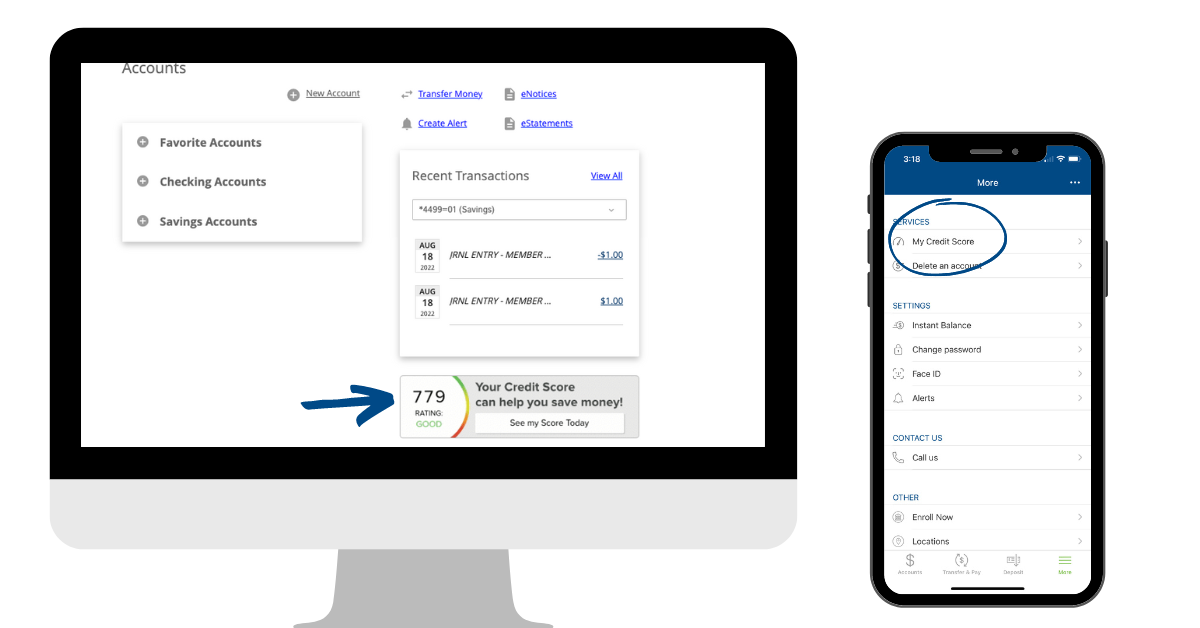

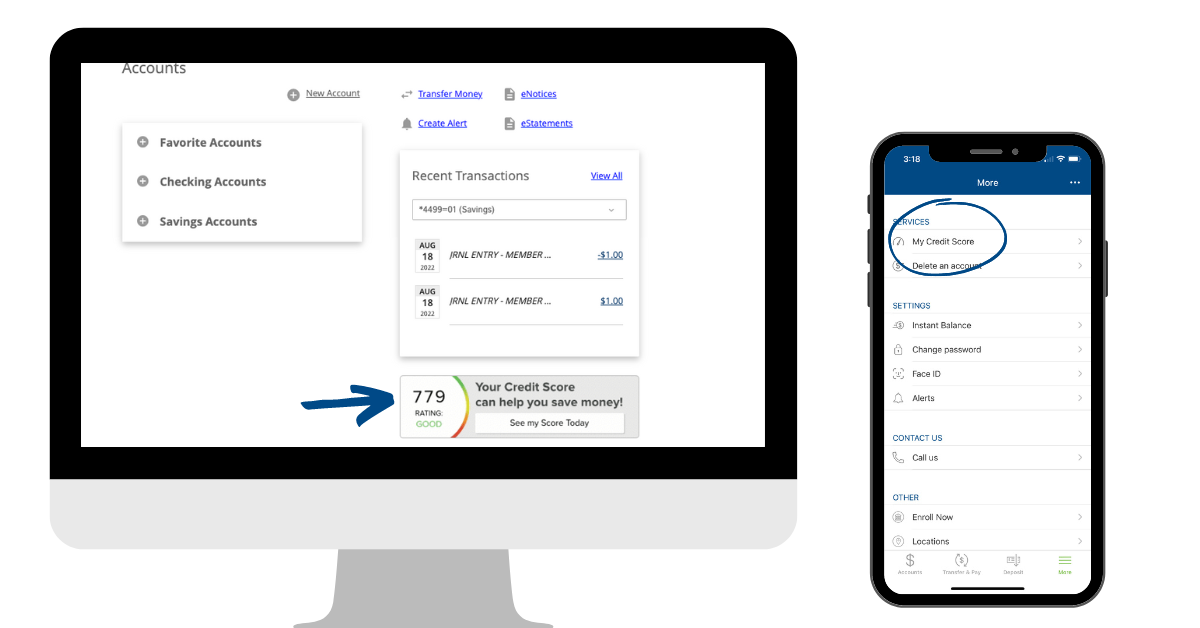

To access this complimentary, valuable resource; enroll through Online or Mobile Banking. From the home page of Online Banking, look for the image "Get My Credit Score" located under your recent transactions. From the mobile app, you can enroll and find your score from under the Accounts section, or under "Services" in the "More" section.

Features and Benefits

- Free to use and refresh your score daily.

- Protect your identity with free credit monitoring and alerts.

- Enjoy personalized tips to understand, establish, improve, and maintain your score.

- Discover ways to save money and reduce debt.

- Find educational articles and videos from financial expert Jean Chatzky.

- Available through both Online and Mobile Banking. Secure login and authentication is required.

FAQs

No! We only use a soft credit pull, which does not affect your credit score.

Log in to Credit Sense → Resources → Profile Settings

Credit Sense uses bank level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to a third party.

Credit Sense also has a sophisticated system that scans for, and thwarts online bots, intrusions and attacks.

Credit Sense’s policies and processes are reviewed annually by a third-party auditor and have been verified by multiple digital banking platforms Security and Compliance teams for meeting their stringent security guidelines.

Credit Score can help you manage your credit so when it comes time to borrow for a big-ticket purchase—like buying a home, car or paying for college—you have a clear picture of your credit health and can qualify for the lowest possible interest rate.

You’ll also see offers on how you may be able to save money on your new and existing loans.

Credit Sense utilizes TransUnion Vantage 3.0 scoring model

- VantageScore® was founded by the 3 leading credit reporting agencies – Experian, Equifax and TransUnion.

- Over 200 factors of a credit report may be considered when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical but should directionally be similar.

- TransUnion is the bureau that offers the most access to educational data

Go to main navigation

tips to improve and maintain your score and customized loan offers to save you money!

tips to improve and maintain your score and customized loan offers to save you money!